When Beeple’s artwork sold last month for a record-breaking $69.3 million, one may have thought that NFTs have gone mainstream.

When Saturday Night Live aired a spoof of the NFT market last month, one may have thought that NFTs have gone mainstream.

When Rolling Stone Magazine published an article with the headline “Music NFTs Have Gone Mainstream. Who’s In?”, one may have thought that NFTs have gone mainstream too.

However, before jumping on the bandwagon, one might want to questions whether a market that is difficult to access, harder to understand, and not necessarily transferable deserves to be called mainstream? We advise caution before comparing NFTs to the collectables market that has established measures of valuation and verification. NFTs are an emerging market, and one should not consider them mainstream investments yet.

What are NFTs, and what is their claim to fame?

NFT stands for Non-Fungible Token. Non-Fungible means that it is unique and not mutually interchangeable, and Token refers to it being stored on a blockchain (a digital ledger).

The NFT contains information on the digital asset and ownership information. Digital assets can be lots of different things, not just artwork. An NFT can represent an item procured in a video game, a musical album (Kings of Leon are going to be the first band to release an album as an NFT), or even a tweet (Jack Dorsey sold the first ever tweet and gave the proceeds to charity for an astounding 2.9 million dollars).

Compared to physical collectables, NFTs are supposed to bring additional benefits to the table. Four of the biggest touted benefits are:

- Uniqueness and Authenticity. Because the blockchain is public information and the token is unique, one could not forge the collectable and it wouldn’t need to be appraised to know whether it’s authentic or not.

- Guaranteed Artist or Author royalties. Unlike a collectable where there are no royalties associated with future trading of the work, the blockchain can be set up in a way that the artist is paid a royalty every time the art changes owners as part of the transaction.

- Inability to be lost or disappear. No need for fire insurance for something that exists on the cloud.

- Access to the market by everyone who has access to a computer, phone, or tablet.

Are these claims legitimate?

Cryptocurrency is complicated. Blockchain is complicated. NFTs that are built on that launching pad are complicated too, and these benefits may not be “incorrect”, but they are misleading. Here’s a simplification of incorrect assumptions one might make based on these benefits:

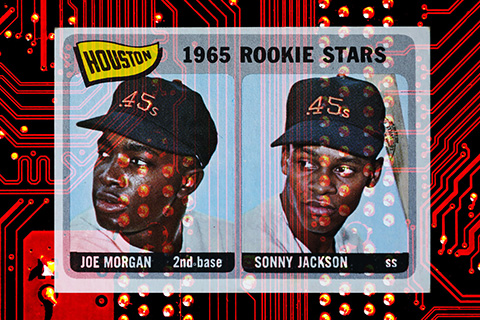

- Myth – There can only be one copy of the underlying asset in an NFT. Although there can only be one token, and the token is not fungible, there could be more than one token for a particular artwork. For example, there could be 500 identical digital baseball cards issued and each has its own token with its own ID. Each is unique because the ID is unique and the limited number does make it a collectable, but the underlying digital artwork is identical for all of the pieces.

- Myth – The authenticity aspect guarantees that the author receives royalties. Although it’s true that NFTs may create a structure that can promote the security of intellectual property, the authenticity only guarantees that the work is the same as it was when it was created on the blockchain. If it’s not authentic at that origin point, the future authenticity doesn’t mean much, and a scammer may attempt to take credit for another’s work at that origin point. In fact, there are many NFTs being sold of artists’ work by scammers without the knowledge of the artists that created them. This article, NFT mania is here, and so are the scammers – The Verge, explores some of the ways one might be fooled, including one piece of art being sold that was actually just the frame around other artwork that buyers thought they were purchasing.

- Myth – It’s not possible to lose things on the cloud. The security for bitcoin and cryptocurrencies may be strong, but there have also been many stories of people losing passwords and access to millions, tens of millions, or even more than a 100 million dollars worth of crypto currency. According to the NYTimes, it’s possible as much as $140 billion exists in lost or stranded wallets and can no longer be accessed. The same may become true for NFTs.

- Myth – Access to the market is available everyone with a computer. While most NFTs are built on the Ethereum cryptocurrency, the second largest after bitcoin, some are built on newer cryptocurrencies that are not as popular. If the underlying cryptocurrency is abandoned, then there will no longer be anyone “mining” it or providing computational power to create new transactions or entries in the ledger. This would make that market entirely inaccessible, even if two willing parties wanted to make a trade.

Many of these myths may be addressed in the future. The idea of digital collectibles, and verification through blockchain, has a lot of interesting merits, and is likely to become more than a fad. Authenticity could be better enforced as part of “minting” or originating the NFTs. Access rules could be adjusted, and cryptocurrency could become less volatile as more institutions embrace it. The estate planning implications may be as substantial as the evolving rules about digital assets, too.