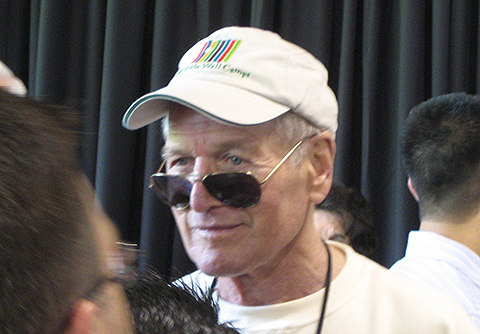

When Paul Newman died in 2008, he left his ownership of Newman’s Own food company to Newman’s Own Foundation. The food company is a for-profit venture, but it gives all of its after-tax profits to charity. The Foundation acquired all “Publicity and Intellectual Property Rights” of the Newman estate. He urged vigilance upon his executors…