With the passage of the legislation that made the federal estate tax exemption permanent at $15 million earlier this year (up to $30 million with portability for a married couple), there is only a very small number of taxpayers who must worry about federal estate and gift taxes moving forward.

However, that doesn’t mean that estate planning isn’t worthwhile or that everyone under that amount is off the hook completely. State estate tax and inheritance tax may be due, depending on the state of residence. Neither New Jersey nor Pennsylvania have an estate tax, but both have a state inheritance tax. The difference in that an inheritance tax is paid by the person receiving the bequest, instead of the estate paying a tax prior to passing along the assets.

For the most part, the inheritance taxes may not come into play either, because the amount due is different based on the relationship the person has to the decedent. The relationships are actually defined into classes, which also vary from state to state, as do the tax rates. Both NJ and PA have a 0% inheritance tax rate when it comes to a surviving spouse or parent.

To see the other classes in NJ please click here for the chart on the nj.gov website.

To see the other classes in PA please click here for a list on the pa.gov website. Please note that there are on-going proposals and legislation to try to reduce or eliminate parts of this tax.

Consider gifting during life to avoid the inheritance tax

If the beneficiaries of an estate plan in NJ or PA include classes that aren’t Class A, it may be wise to consider giving them the assets during life instead, because neither state has a separate gift tax. A program of tax-free annual gifts (up to $19,000 per beneficiary in 2025, $38,000 per couple) can be an easy and effective method for reducing future inheritance taxes. Larger gifts could be made as well, but they require federal gift tax returns, even though no federal gift tax may be payable.

A big caveat! The states don’t want the gifts to be a last-minute attempt to avoid taxes, so the inheritance tax would still apply to “death-bed gifts”. This refers to gifts made in contemplation of one’s impending demise. Under New Jersey law, any gift made within three years of death is presumed made “in contemplation of death” and would have the inheritance tax applied as a death-bed gift. In Pennsylvania, the “death-bed” scenario isn’t quite so long, only one year.

Therefore, this strategy should be started early, especially as it may take many years for the gift amount to add up to what you want the inheritance to be.

Should you worry about estate taxes or inheritance taxes at this point?

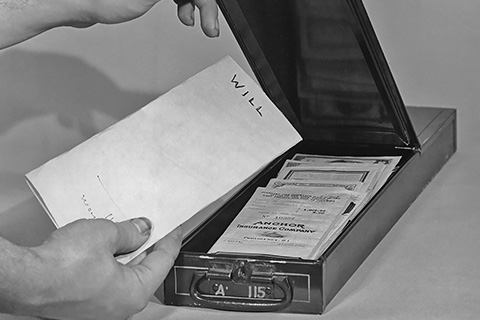

The greatest reason to have an estate plan is still to decrease hardship for the beneficiaries, reduce arguments and fights, and clarify your preferences for how your property should be distributed. Although the reduction in the number of people the federal estate tax will apply to in the future may make people think estate planning isn’t as important, that has always been the tail wagging the dog so to speak, and estate planning is still crucial to familial harmony and wealth transfer for maintaining a legacy across generations.

Before the passage of the bill, we published an article about three non-tax reasons to have an estate plan. These are more likely to drive decisions than estate or inheritance taxes at this point.

Our Professionals at Garden State Trust Company

We have experience dealing with the problems and pitfalls of families’ wealth management and transfer. Our staff is sensitive to the types of issues that could arise and would be glad to speak with you about how to best achieve your goals.

Contact us to schedule a meeting.

This content has been prepared by The Merrill Anderson Company and is intended as a general guideline.

©2025 M.A. Co. All rights reserved.