The economy is a bit big for anyone to conceptualize all that well. It’s easy enough to go from $10 to a hundred, thousand, or even a million. One can still think of individual products that can be purchased in those terms and the people that interact with those products and their wealth levels. The U.S. economy’s Gross Domestic product is way beyond that though, in the trillions of dollars (estimated at a little over $27 trillion in 2023). Think of it this way: One million seconds is 11.5 days. One billion seconds is about 32 years. One trillion seconds is 32,000 years.

This may be one of the reasons why colloquial “easy to approach” indicators are sometimes used instead of looking at big numbers and averages.

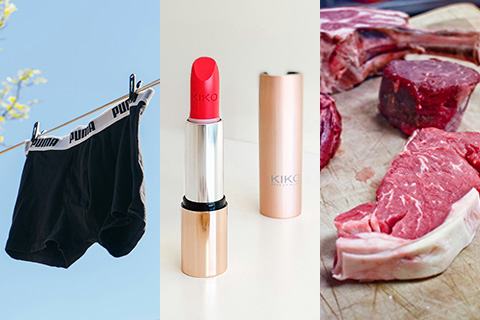

Although the following indicators might seem like jokes, and at the very least, be fun to have in your back pocket for conversation starters, even noted economists such as Alan Greenspan mention giving the men’s underwear index some weight.

Here are three unusual indicators that you may want to watch, or share-

The Men’s Underwear Index

According to this interview from NPR, Alan Greenspan would be looking at a wide variety of indicators, including even the sale of men’s underwear. The theory was that because it was a garment generally not seen, men would wear it to tatters when their budget was tight. Because the market is so stable most of the time, even a small dip might be a meaningful indicator that something has changed.

The Lipstick index

The idea of the lipstick index is that lipstick sales actually increase in a recession or with a recession coming up. This might seem counterintuitive, because one would think that any cosmetic purchase would be considered luxury and discretionary. However, because lipstick is inexpensive as cosmetics go, the potential trend is that more expensive cosmetics are substituted with additional inexpensive lipsticks. Some have hypothesized similar inverse relationships with other beauty products as well in recent years.

The Red Meat Index

Some believe that falling sales of red meat means a change from a food staple that’s more expensive to one that’s less expensive (pork or chicken), indicating budgets being stretched to the limit. Recently, some have countered that red meat has increased in price more quickly due to supply constraints, causing a shift in consumer demand against new prices rather than historical norms of consumption. The Dallas Fed’s recent survey with manufacturers had a meat producer who has a similar theory, except about the increase in sausage sales rather than the fall in beef sales:

“As the economy weakens, we are seeing modest growth in our category of dinner sausage. This category tends to grow when the economy weakens, as sausage is a good protein substitute for higher-priced proteins and can ‘stretch’ consumers’ food budgets.”

There are many other small correlations we could extrapolate from in our trillion-dollar economy. Some of them may even have causal links, though proving that would be extraordinary given the massive amount of potential for other factors to be responsible. One correlation to consider might even be the number of these correlations and theories that are floating around, with more theories meaning economic analysts are grasping at straws because their usual data isn’t as predictive as they would like.

Whether these examples are spurious correlations or have causal links, there are underlying factors that are driving our economy forward. One of those factors may be consumer confidence, which last month hit a six-month high, another might be the amount of debt Americans hold which also hit new records this year. As investors, instead of trying to figure out where the economy is heading, we need to have an “all-weather” plan that works regardless in every sort of market.

It is important to determine how to mitigate the damage in bad times and increase the gains in good times. That’s where understanding the time horizon and portfolio risk analysis comes into play, along with an asset allocation strategy to match and that’s where Garden State Trust Company has useful benefits to offer, helping our clients with building and managing their portfolios. Let us know if you’d like more information.