When Paul Newman died in 2008, he left his ownership of Newman’s Own food company to Newman’s Own Foundation. The food company is a for-profit venture, but it gives all of its after-tax profits to charity.

The Foundation acquired all “Publicity and Intellectual Property Rights” of the Newman estate. He urged vigilance upon his executors in protecting his image after his death, hoping that his likeness would never be used in ways that he did not approve of during his life, nor to sell food products inferior to the current Newman’s Own line.

The problem is that the tax code prohibits private foundations from owning more than 20% of a for-profit company (35% in some circumstances). This law is meant to prevent individuals from using private foundations as a tax shelter for their active businesses. The Foundation had until November 2018 to divest 80% of its ownership of the food company, or it would face crippling excise taxes.

It has lobbied for years to be able to continue on its current path, and a legislative change to the tax law this year added into the Bipartisan Budget Act of 2018, called the Philanthropic Enterprise Act of 2017, allows it to do just that.

This case is exceptional, because there is no individual who could be benefiting from a potential tax shelter. Nevertheless, a legislative exception can’t be made for a single business, and generalities could cause potential misuse.

Thus, the legislation has been very carefully constructed to restrict the usage of this exception – so much so that it’s unlikely that it will ever apply to any other entity. On the other hand, perhaps Paul Newman’s estate planning could become a model for future charitable estate planning of those in a similar situation to his.

The primary restrictions for this exemption include:

- The private foundation has exclusive full ownership of the for-profit business, which was acquired under the terms of a will or trust.

- The for-profit business gives 100% of its profits to the private foundation.

- The private foundation can’t be controlled by its original creator, or family members.

- The for-profit business cannot have outstanding loans to substantial contributors to the private foundation or family members.

Basically – It would have to follow Newman’s Own story.

The full text of the exception can be found here.

Paul Newman’s estate planning beyond the foundation

The cornerstone of Paul Newman’s estate plan, mentioned in his will, is the “Amended and Restated Living Trust Number One,” executed before the will. The terms of that trust were not published, nor what assets it held. We do know that the living trust was the residuary beneficiary of Newman’s estate; that is, any property not identified and transferred specifically by the will passed to the trust. We know from a provision in the will that the living trust provided for Newman’s descendants, and that for descendants less than 35 years old when Newman died, separate trusts were to be created. Finally, we can tell from the will that a marital deduction trust was carved out of the living trust for the benefit of Newman’s surviving spouse, Joanne Woodward. The will provided that the marital trust would be funded with Newman’s interests in production companies and the royalties and residuals due Newman from his acting career. Newman’s will also mentions that he may provide a memorandum to his executors.

The memorandum would suggest various gifts, but it would not be binding on the executors, nor would it be published, securing an additional zone of privacy. Somewhat more detail was provided regarding the legacy to Newman’s Own Foundation, which has continued his philanthropic work.

Key takeaways: An estate plan can support philanthropy as well as private beneficiaries. A living trust is a great mechanism for managing wealth that will stay in the family.

Interested in how trust services might help your family? Contact a Garden State Professional to learn more.

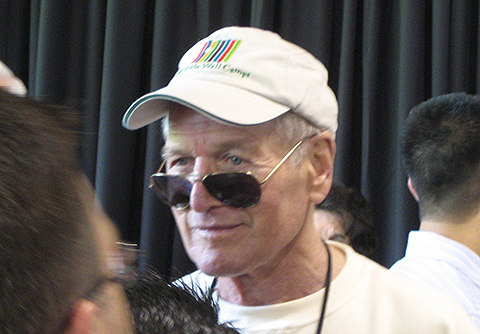

Photo By TriviaKing at English Wikipedia, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=4939146