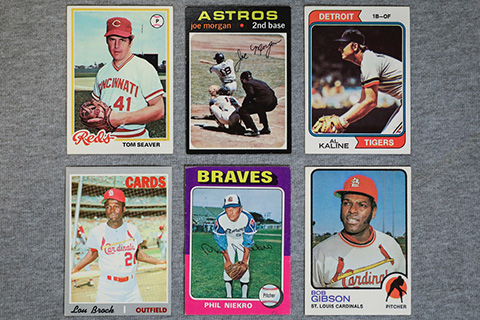

Yogi Berra once said “records and achievements are meant to be broken”. His words were likely meant more to apply to actions of new players rather than the value of the denotation of earlier players by their baseball cards. Nevertheless, his words are applicable as another baseball record is surpassed: the most ever paid for…

Blog

What Are the Odds?

When it comes to lotteries, the odds of winning are vanishingly small. In fact, the odds of winning the Jackpot in the Mega Millions lottery is 1 in 302,575,350. It is often said that you are more likely to be struck by lightning, and although the odds for lightning strikes vary over the country, the…

Planning Ahead For the Digital Estate

When we think of property, we generally think of tangible things. Land. Stocks. Paintings. However, in our new digital age many of the things we own are digital as well. Intellectual property. Cryptocurrency. NFTs. These properties need to be valued and accounted for in estate planning, so they can transition in an estate just like…

Incentive Trusts

An incentive trust is a trust that includes provisions requiring beneficiaries to meet certain conditions before the trustee can distribute funds. This means that the funds can only be accessed in specific situations or for specific needs. Some incentive trusts give the trustee the authority to spread distributions out so the beneficiary doesn’t receive them…

Should I Retire To the Sea?

As retirement approaches, we may wonder about downsizing our living space, or even moving to a new area entirely. The perfect retirement has many elements, and is more than just having enough money to make work an option instead of a requirement. One of the hardest things is realizing that you are the leader of…

Another Roth IRA Advantage

The traditional IRA and the Roth IRA both will grow without income taxes reducing returns. The difference is that contributions to a traditional IRA may be tax deductible (depending upon income), and all distributions during retirement are taxable as ordinary income, while contributions to a Roth IRA are not deductible, but withdrawals are potentially free…

Factors Beyond the Fundamentals

In recent weeks there have been calls by Ukrainian officials for companies to take a stand against the Russian invasion, and many companies have responded beyond the government sanctions. This is not the first time that companies have taken a stand on political issues. Some companies make a point to embrace social issues as well,…