Last month you may have noticed signs in gas stations reading $999 for the Powerball jackpot. The signs weren’t designed to go into the billions, so that’s their max readout, but the winning ticket (should it be an individual ticket) exceeded millions into more than a billion dollars! Many of us dream of being suddenly…

Author: gstc

Getting Ahead of Wealth Transfer Squabbles With a Family Meeting

The great wealth transfer is coming, and some may have considered it started already, yet we are woefully underprepared. Not just millions or billions of dollars, but trillions of dollars that will need to be transferred. Not just one or two trillion dollars, but twenty to thirty, and some estimates suggest even more. According to…

Marriage and Personal Finance

Weddings are happy and momentous occasions, turning points on the path of life. In the exciting preparations for the celebration, sometimes the financial implications of the new marital partnership can be overlooked. These will affect the newlyweds, of course, but there are also considerations for the extended family. Personal income taxes For tax purposes, there…

The Federal Estate Tax Exemption Doesn’t Help With State Inheritance Taxes

With the passage of the legislation that made the federal estate tax exemption permanent at $15 million earlier this year (up to $30 million with portability for a married couple), there is only a very small number of taxpayers who must worry about federal estate and gift taxes moving forward. However, that doesn’t mean that…

Make Grandparents Day Special

Although it is natural to celebrate our grandparents every day, it is also nice to designate a special day for special appreciation too. An effort to do so nationally began with 9-year-old Russell Clapper writing a letter to President Nixon in 1969. It wasn’t as easy as just sending a child’s letter to create a…

Lessons from Jimmy Buffett’s Estate

About that choice of trustee Wastin’ away again in Margaritaville Searchin’ for my lost shaker of salt Some people claim that there’s a woman to blame But I know it’s my own damn fault —Jimmy Buffett, Margaritaville, third chorus The estate of singer-songwriter Jimmy Buffett, who died in 2023, looked well planned. Under his will,…

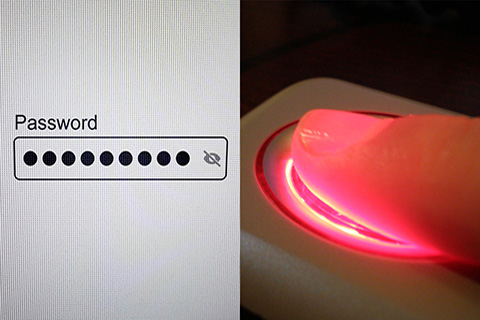

Passwords or Passkeys?

You may have seen news or read articles last month about a breach of over 16 billion passwords, more than twice the number of humans on this planet. This sensation-grabbing headline has been contested by some, claiming that the number may be inflated with duplicates or may include older leaks. Either way, this Forbes article…