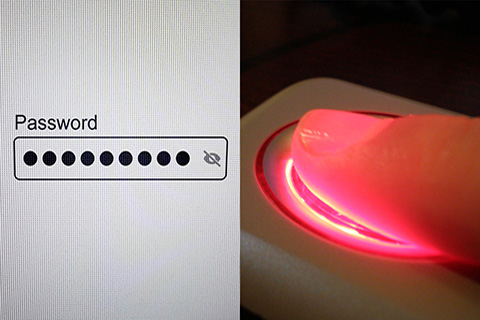

You may have seen news or read articles last month about a breach of over 16 billion passwords, more than twice the number of humans on this planet. This sensation-grabbing headline has been contested by some, claiming that the number may be inflated with duplicates or may include older leaks. Either way, this Forbes article suggests that the password era is drawing to a close, so it’s time to start thinking about switching to passkeys instead.

The world changes fast, even when it comes to certainties such as death and taxes. When it comes to the transition of assets, an entirely new asset class, digital assets, needs to be taken into consideration. Passwords may be going out the way of the VCR and Blockbuster Video as Passkeys and biometric locks become more common. That means that a fingerprint, or FaceID is needed (or in some cases a PIN can be utilized instead). Biometric locks are hard to use when a person is six feet underground though, so careful consideration should be given to what locks are used to protect digital assets.

When digital assets are brought up people think of Bitcoin and other cryptocurrencies, but those are just the latest addition to the mix of digital assets. Digital assets are electronic ones and zeros; that is, information inscribed on a tangible medium or stored in an electronic or other medium and which is retrievable in perceivable form.

Common types of digital assets include:

Personal. Personal digital assets include e-mail and text messages, e-books (e.g., Kindle and Nook), word processing and .pdf files, photographs, videos, music files (e.g., mp3s and iTunes), spreadsheets, PowerPoint presentations, tax records and returns, and similar materials. They may be stored on a variety of devices, such as computers, tablets, smartphones, e-readers, cameras, hard drives, memory cards, CDs and DVDs, or online in the cloud. Each of these storage techniques often requires different means of access, including usernames, passwords, answers to “secret” questions, biometric data (e.g., fingerprint or retinal scan), and gestures.

Social Media. Social media assets involve interactions with other people on websites such as Facebook, Instagram, TikTok, LinkedIn, X, and others. These sites are used not only for messaging and social interaction, but they also can serve as storage for photos, videos, and other electronic files.

Financial Accounts. Many people manage their financial affairs online, including bank and PayPal accounts, investment and brokerage accounts, bill payment (e.g., utilities, credit cards, car note payments, mortgage payments), and income taxes. Some have digital wallets with cryptocurrencies on the cloud, and others may have a physical flash drive where the digital information is stored.

Business Accounts. Business owners are likely to have customer databases containing names, addresses, and credit card information, along with information such as order history and pending orders. A professional such as a physician, attorney, or CPA may have client records, many of which will contain confidential information.

Other Digital Assets. In this category are items such as domain names, blogs, loyalty program benefits (e.g., frequent flyer miles, credit card rewards, and business discounts or vouchers), and gaming property (e.g., virtual money, avatars, or other assets earned when playing online games).

Most people will have digital assets, though not everyone will have a situation where those assets need to be protected or passed on as part of the estate plan. Should you switch to passkeys over passwords, additional consideration needs to be made about sharing those passkeys (in some cases you can create a shared group, such as Apple describes here).

Careful protection of digital assets can help those charged with managing the estate, and help to reduce the possibility of identity theft. Imagine it is winter, no one is living in the decedent’s house after passing, and some bills were being paid electronically. Suddenly, without a clear picture of what was being paid through online banking, the furnace is shut off and the pipes freeze!

The cost may be emotional too. Historically, people kept special pictures, letters, and journals in albums, scrapbooks, or shoeboxes for future generations. Today this material is stored on computers or online and often is never printed. Without alerting family members that these assets exist and without telling them how to get access to them, the story of the life of the deceased may be lost forever. When considering these stories and sharing your own story digitally or creating a diary to share, realize that there are also services that can help facilitate that process. One of those is called Storyworth, and it provides questions to stimulate stories which can then be printed as a book later on if desired.

Whether you are switching to Passkeys or sticking with Passwords – An important piece of advice is to never respond or engage with emails or text messages asking you to reset a password. These messages need to be initiated by you, and you should always login through your normal channel on the app or website rather than following a link in the email or text message.

To learn more about your digital estate, we have created an informational sheet available here. If you would like to learn more about how we can help you with your estate plan, we would love to hear from you so please contact us today.